Your donation will support the student journalists of Iowa City High School. For 2023, we are trying to update our video and photo studio, purchase new cameras and attend journalism conferences.

Taking the Next Step: College Costs and Communities

Growing Up Hawkeye: Students share their opinion on attending the University of Iowa after growing up in Iowa City. ClusterFlunk Passes Test: A new forum for college students to share notes and get help has emerged. Ascending College Debt Causes Concern: We focus on the rising cost of college and the benefits of student loans.

February 14, 2014

Growing Up Hawkeye

Walking downtown Iowa City on a Friday night, the slapping of college students feet along the cobblestones can be heard well into the next morning.

“Even as a freshman I felt like I was one of the people saying I would never go to Iowa, but the more I thought about it the more realistic it was,” Mary Kelly ‘14 said.

Kelly made the decision to go to the University of Iowa after a handful of her relatives spoke to her about their experiences.

“I’ve talked to a lot of people who say that even though it is in the same town, it’s a totally different experience and that makes it a different place,” Kelly said.

After living in Iowa City their whole lives, seniors going to the University of Iowa have been molded into their decision since they were little. Growing up in Iowa City, walking around downtown, and going to University events and cheering for their teams, Iowa City teens have grown up accustomed to life in a college town.

“The fact that I was raised here and I know my way around makes me want to stay. And since I’ve grown up in this environment, I already know I like the dynamic of Iowa City,” Katrina Scandrett ‘15 said. Scandrett is a junior at City who is already considering going to the University of Iowa.

According to Eric Page, Senior Associate Director of Strategic Communications in the Office of Admissions at the University of Iowa, a major percentage of Iowa’s freshmen came from City High and West High, 80 and 97 freshmen respectively in 2013.

Scholarships play a large part in local high school students attending the University. There are specific scholarships for students who have grown up and attended high school in Iowa, including the Iowa Scholars Award and the Old Gold Award.

“It sounds like a fun place, and I’m going there for engineering, I knew I wanted to stay in state, and I think it’s the best engineering school in Iowa. It’s cheaper, and I would probably get homesick somewhere else,” Brady Swenning ‘14 said.

Assuming that it will be the same experiences they had growing up, some seniors choose to move farther away to get a fresh start.

“I think it’ll be fun to experience something new and be in a new town. Change is good, and when you’re learning to be an adult and fend for yourself, I think if you’re farther away from your parents and not depending on them so much that you’ll end up exceeding a little more in figuring out how to live your life independently,” Amber Slater-Scott ‘14 said.

Sam Cavanaugh ‘14 has also been looking for out of state colleges.

“I really like the dynamic of Iowa City, and how liberal it is, but for a college experience I want something that I am going to remember for the rest of my life, I don’t want it to just be about partying, and at Iowa it’s inescapable,” Cavanaugh said.

Ryan Dorman ‘14 has grown up around the University, since his mother is a professor and admissions adviser.

“I knew I didn’t want to go to Iowa, but now it seems like my best option. I wanted to get away. I still want to get away, but costs and other factors limit that. I feel safe here, I know the town really well, and I know about the University in general,” Dorman says about his decision to stay in town and attend the University.

“Personally, I think there is something special about growing up in a college town like Iowa City and then attending the University. You feel a really strong connection with the place that lasts a lifetime. For some students, they want to get away and experience something different. It’s all about personal preference and how a student fits at a University,” Page said.

ClusterFlunk Passes the Test

ClusterFlunk Passes the TestThe clock on Joe Dallago’s computer blinks 12:00. It’s midnight, and he has been stuck on the same problem for the past hour, unable to complete the study guide without the answer. No answer to his email to the professor, no response from the TA, and the final is tomorrow morning.

“That one hanging point cost me the exam,” Dallago, co founder, said.

Sitting in a library full of students, and in a class of 300 students, he wondered why there wasn’t a way for him to get help.

“It kind of just baffled us that there wasn’t a tool for you to simply go talk to the other students in your class. It’s a basic need,” AJ Nelson, co founder said.

Joe Dallago and AJ Nelson needed an answer, so they made one. ClusterFlunk is a free online forum for college students to connect with classmates, TA’s, and professors to get answers to questions, share study guides, and give helpful hints.

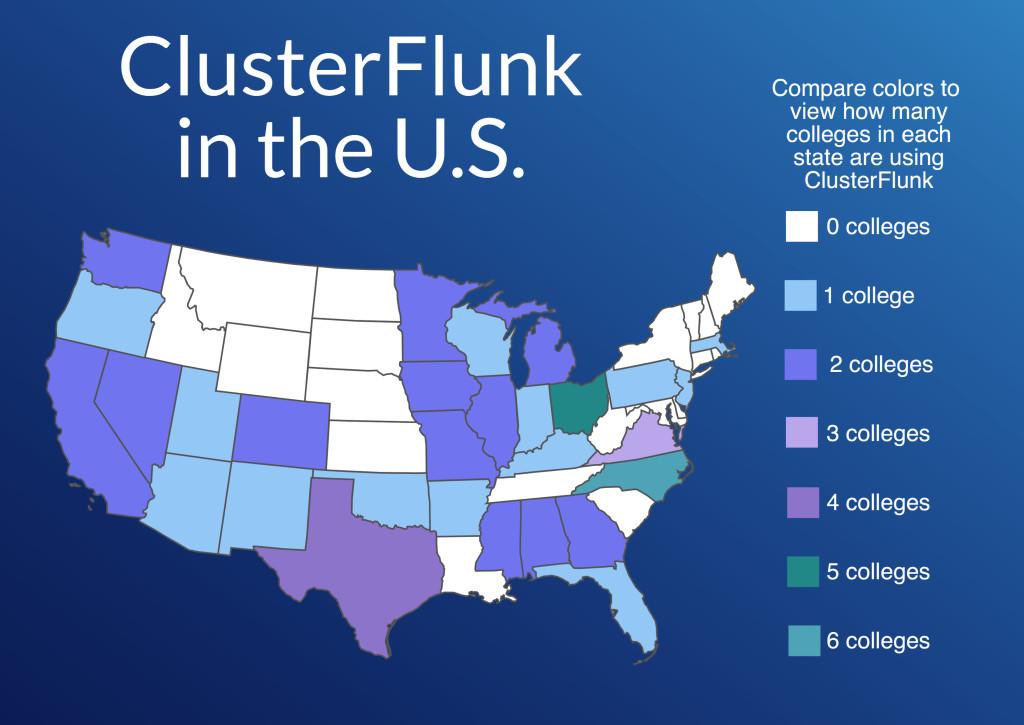

Business major Nelson and Computer Science major Dallago dropped out of college their junior year after deciding ClusterFLunk was their true passion. After a lot of advice from mentors on how to start a company, they are now the owners of a $500,000 company that is produced to 52 colleges around the United States, with over 11,000 users.

ClusterFlunk is free for all users, the only requirement is a .edu email address, and to attend one of the available colleges. Originally aimed at University of Iowa’s students, they began with a test group: The University of Iowa, University of Northern Iowa, Kirkwood Community College in Cedar Rapids, and Cornell College in Mount Vernon.

The criteria for colleges has changed to require the college to have a lecture based class structure, and to have more than 15,000 students attending the college. Having recently expanded the database to around 50 colleges, Nelson and Dallago eventually hope to reach all colleges.

They are also considering the possibility of ClusterFlunk being available to high schools, although high school teachers are skeptical of marketing parties and ClusterFlunk’s mature Facebook profile.

The company received initial scrutiny about the name and legality of its forum. The DailyIowan released the first headline about ClusterFLunk, saying “UI students create collaborative study website, officials not concerned.” The founders admit that they have always had people question the choice of the name, but they are not overly concerned with what officials and professors say, they are choosing to focus on the students.

“We learned from day one that if we were going to build a product for the students, that the students needed to be the focal point,” Nelson said. “It really only mattered what the students thought.”

Levi Hacker, sophomore at the University of Iowa began using ClusterFlunk after it was recommended to him by a friend.

Levi Hacker, sophomore at the University of Iowa began using ClusterFlunk after it was recommended to him by a friend.

“I take my own notes in class, and then back them up by studying notes other people have posted on ClusterFlunk. But sometimes I ask a question on a page, and nobody answers. So it’s not always helpful in answering specifics, but is really helpful in studying notes and getting study guides,” Hacker said.

Founders work daily on improving usability, marketing, contacting users to find out what’s wrong, and pushing new versions of the site, but get paid nothing to produce the site. Living off of investments, Nelson and Dallago have the students best interests in mind.

“We take a strong stance that ClusterFlunk is specifically produced for the students,” Dallago said.

In response to legal speculations, they claim that students are not allowed to post pictures of copyrighted materials or tests. A system is being set up to allow students to monitor themselves and each other, becoming “administrators” on the site.

Best friends since high school, Nelson and Dallago aren’t sure if ClusterFlunk will be their life-long job, but hope to expand it as far as they can, for as long as there is a need.

Ascending College Debt Causes Concern

Ascending College Debt Causes Concern

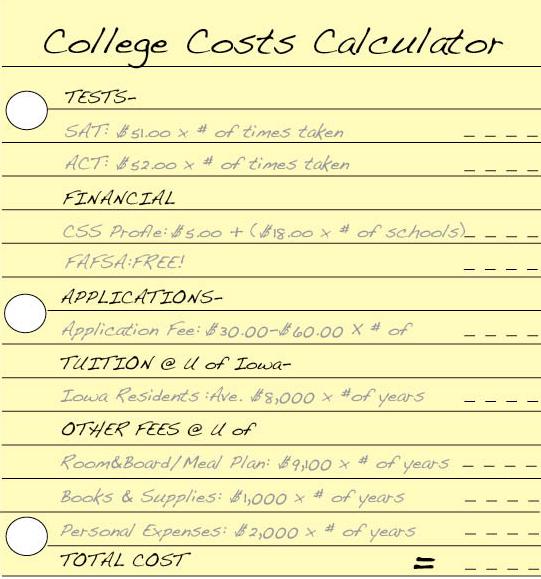

Many children begin dreaming about what they want to be when they “grow up” at a young age. From doctors to astronauts, or maybe even princesses, the majority of these professions require further schooling after high school. Most students make the decision to go on to college, but there are multiple factors involved in the selection process, one of the most important being cost.

Not every student qualifies for scholarships or grants, which is where the alternative of student loans comes in handy. Student loans are loans provided by the government or a financial institution as a secondary option to help pay for a student’s education. Different from a grant, which is an amount of money given to a student by the government based on financial need, a loan is money borrowed from the government that eventually begins to accumulate interest.

“The best kind of student loan is to not have a loan. That said, it is getting increasingly harder to go to college without taking out any sort of student loans,” Steve Lindley, Assistant Director of Financial Aid at St. Olaf College said. “Student loans are like a lot of other things: in moderation, they are fine, but if you take out too many that can be a bad thing.”

While loans may sound like a flawless backup plan to college bound students, there are negative aspects as well. Many different types of loans are available for students through the government. All loans are either subsidized or unsubsidized. Subsidized loans are administered to students demonstrating some sort of financial need, where the lender pays the the interest while the student is in school up until six months after they are no longer enrolled. Unsubsidized loans are given to any student, with or without financial need, where the student is responsible for paying interest at all times. Due to fluctuating interest rates, students end up paying a substantially higher amount than what they originally borrowed. Interest, even without accumulating until months after college graduation, continues to accrue until the loan is completely paid off, thus forcing students deeper and deeper into debt.

Too much debt can even go as far as to jeopardize a student’s financial success in the future. According to the College Board, the average amount of student loan debt accumulated for each of the 54% of students that took out loans in 2012 was $25,000. The amount of debt accumulated throughout a student’s college career can have a significant effect on their future choices. If a student takes out multiple loans for a degree in a profession that won’t be very profitable, their financial security can be significantly impacted.

“The amount of student debt may also influence the type of occupation the student chooses as well as the geographic areas where jobs are sought,” Mark Warner, Assistant Provost for Enrollment Management and Director of Student Financial Aid at the University of Iowa said. “High student debt could have an influence on other life choices including marriage, having children, purchasing a house, etcetera.”

However, loans are the only key to affording an education for some people.

However, loans are the only key to affording an education for some people.

“In my opinion, college is a long term investment,” Addie Bockenstedt ‘14 said. “Without a college degree the chances of finding a supporting job are lower. You have to spend money to make money.”

Many current professions require a college degree. Without that, finding a well-paying, supporting job is nearly impossible. As long as it means receiving a proper post-high school education, benefits to taking out student loans are evident.

“It’s okay to get a little bit of debt as an investment for yourself, and some debt is certainly okay, but there is definitely such a thing as too much undergraduate college debt,” Tom Carey, Guidance Counselor, said. “You have to be aware and plan based on what you’re going into and how much earning power you’re going to have.”

The government has introduced a newer law, the Bipartisan Student Loan Certainty Act of 2013, that will ultimately lower student loan interest rates for millions of college students. The new law will attach interest rates to the market and bound the rates for the life of the loan. It will also guarantee a cap on interest rates, promising that undergraduate rates can’t rise above 8.25 percent, graduate loans can’t rise above 9.5 percent, and PLUS loans provided by the government can’t rise above 10.5 percent. This will benefit people in student loan debt, as previously interest rates were able to rise and fall with the economy, without any limits.

Outstanding student loan debt is now the second largest form of consumer debt. According to an article by U.S. News, in June of 2013, more than 7 million borrowers are in default on federal or private student loans, meaning that they were over 270 days late on a payment. However, there are further resources available to reduce or eliminate overwhelming student loan debt. If applicable, many scholarships and grants are available for prospective college students from various sources such as their current high school, future college, or the local community. Need-based financial aid is also awarded to students from families struggling to afford additional schooling, different amounts being given based on the level of financial need.

“The family need to start planning early for meeting future college costs,” Warner said. “The parents and students need to form a partnership and research together what other financial resources are available. The primary responsibility for paying for a college education lies with the family, and need-based financial aid is there to help where the family cannot.”